Last updated May 15th, 2023

If you’re asking yourself, “What is DCAA compliance?”, this article was written just for you. We know it can feel overwhelming to ensure you’re doing everything to stay compliant when there is a long list of important requirements. But have no fear! We are here to answer the most asked questions about DCAA compliance. Plus we offer up 4 helpful tips to make sure your firm’s on the right track to stay compliant.

What is DCAA compliance?

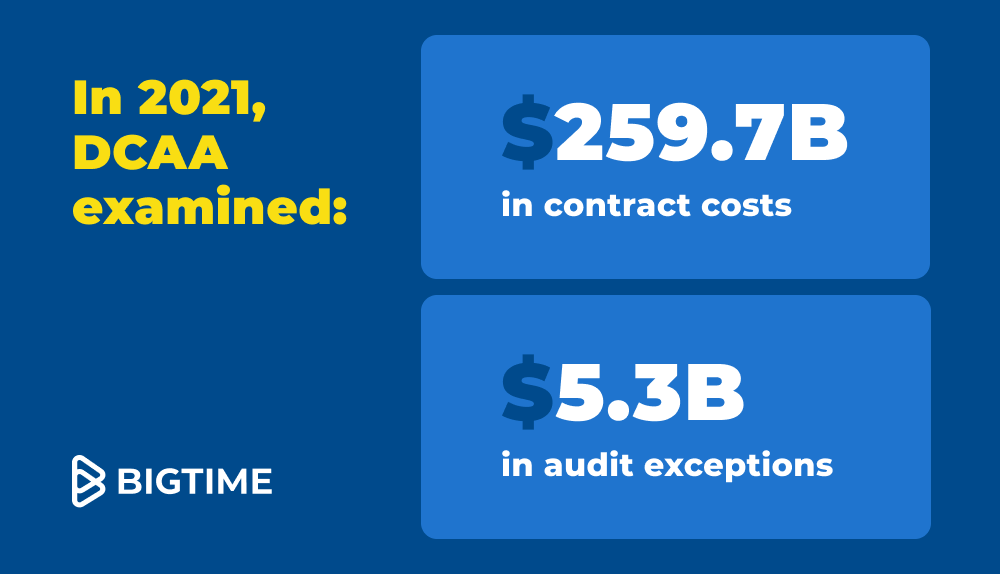

The Defense Contract Audit Agency (DCAA) has an important role in ensuring the proper use of taxpayer dollars and military funds. As the agency responsible for performing all contract audits for the United States Department of Defense, the DCAA aims to maintain the integrity of government contracting processes. But their scope of work extends beyond the Department of Defense. They also offer accounting and financial advisory services to other government agencies. With their audits, the DCAA seeks to identify any potential risks, errors, or fraud in the contracting process. By doing so, they help ensure that the government’s financial resources are used efficiently and effectively.

Why is it important to be DCAA compliant?

Being DCAA compliant is crucial for firms that want to pursue government contracting work. Failure to follow DCAA regulations can result in a poor audit trail, which may lead to the disqualification of your firm from future government contracting opportunities. In addition, the DCAA has the authority to recommend the stoppage of payments on ongoing projects if they find that the work is not being performed in compliance with their regulations. This could result in significant financial losses for your firm, not to mention damage to your reputation.

On the other hand, being DCAA compliant can help your firm stand out as a trustworthy and reliable partner for government agencies. By following DCAA regulations, you can ensure that your engagements involving a government group are conducted smoothly and successfully. It’s worth taking the time to understand and implement these procedures to avoid potential risks and ensure the longevity of your government contracting business.

What is the difference between DCAA and DCMA?

While these two agencies are similar, they have different missions. The DCMA is tasked with the administration work of DoD contracts and the DCAA is tasked with the financials and accounting aspects of the contracts.

DCMA Responsibilities

While both the Defense Contract Audit Agency (DCAA) and the Defense Contract Management Agency (DCMA) play a critical role in government contracting, their responsibilities and focus areas differ. The DCMA is responsible for the administration of Department of Defense (DoD) contracts, which includes monitoring the contractor from the time the contract is awarded to contract closeout. They ensure that the contractor complies with the terms and conditions of the contract and that the deliverables meet the DoD’s requirements.

DCAA Responsibilities

On the other hand, the DCAA is responsible for monitoring and auditing the accounting system used by contractors throughout the contract. They ensure that the contractor’s financial records and systems are accurate and comply with government regulations. This includes reviewing financial statements, accounting practices, and internal controls to identify any potential risks or fraud.

In short, while both agencies work together to support the DoD’s contracting process, the DCMA focuses on the overall administration of contracts, while the DCAA specializes in monitoring and auditing the financial aspects of the contracts. Understanding the differences between these two agencies is essential for firms that want to successfully navigate the government contracting process.

DCAA Compliance Requirements

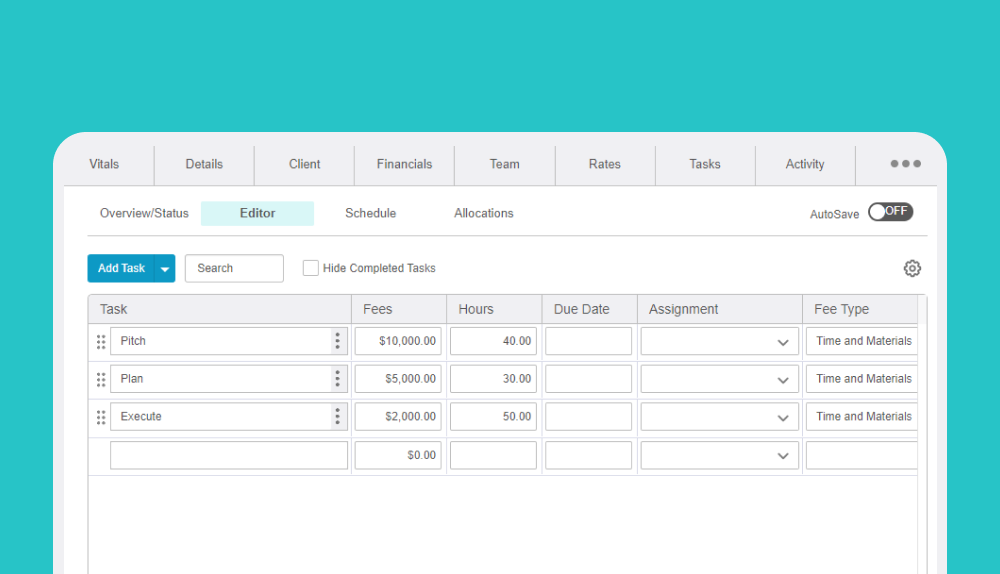

There are a number of requirements set out by the DCAA in order to help contractors with their timekeeping and accounting on government contracts.

- Timesheets must be completed every day and can’t be changed after they are submitted

- Project numbers and descriptions need to be clear

- Overtime and time off should be accurately recorded

- Timesheet and payroll approvals must be performed by different parties but you can integrate your time tracking and accounting systems to save time and money

The level of organization and accuracy required by the DCAA has moved a lot of contractors and businesses away from paper timesheets to digital time tracking and accounting solutions.

DCAA Accounting Requirements

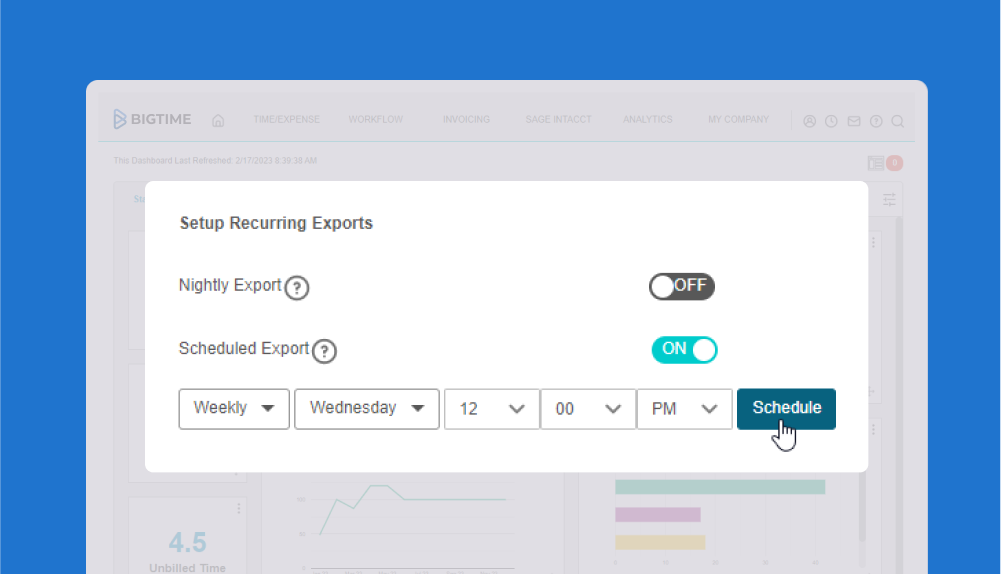

Using timekeeping software, as opposed to manual tracking, helps prevent staff from going off policy. Look for a DCAA-compatible time and billing software that can be configured to follow DCAA regulations automatically, such as blocking late entry of time or preventing timesheets with errors from being submitted.

Having a system with set review and approval processes also makes staying compliant seamless. Lastly, make sure the timekeeping system you choose can integrate into the accounting tool of your choice, as the main importance of compliant time tracking is to guarantee accurate accounting and billing.

DCAA Timekeeping Requirements

DCAA-compliant timekeeping follows regulations set in place to ensure government contractors follow the rules of the Federal Acquisition Regulations (FAR). The FAR system makes certain every process in which the government purchases goods or a service is the same.

For contracted services, the money spent associated with hours worked requires a specific set of rules meant to prevent any inaccurate tracking of time. Get a breakdown of the specific actions needed to be DCAA compliant in a helpful blog below.

DCAA Compliance for Small Businesses

These regulations are important for all businesses that want to take on government contracts, no matter how many employees they have. It does become simpler to accurately reflect hours to specific projects with a smaller team, as well as prepare an audit trail. This actually encourages small businesses to be more relaxed on the requirements at times but it’s important to keep compliance top of mind.

To help your small business remain DCAA compliant, you can rely on accounting software that follows Generally Accepted Accounting Principles (GAAP).

Many small businesses use QuickBooks and there’s no need to change solutions because QuickBooks can be configured to meet DCAA compliance requirements if paired with a robust timekeeping and reporting solution like BigTime.

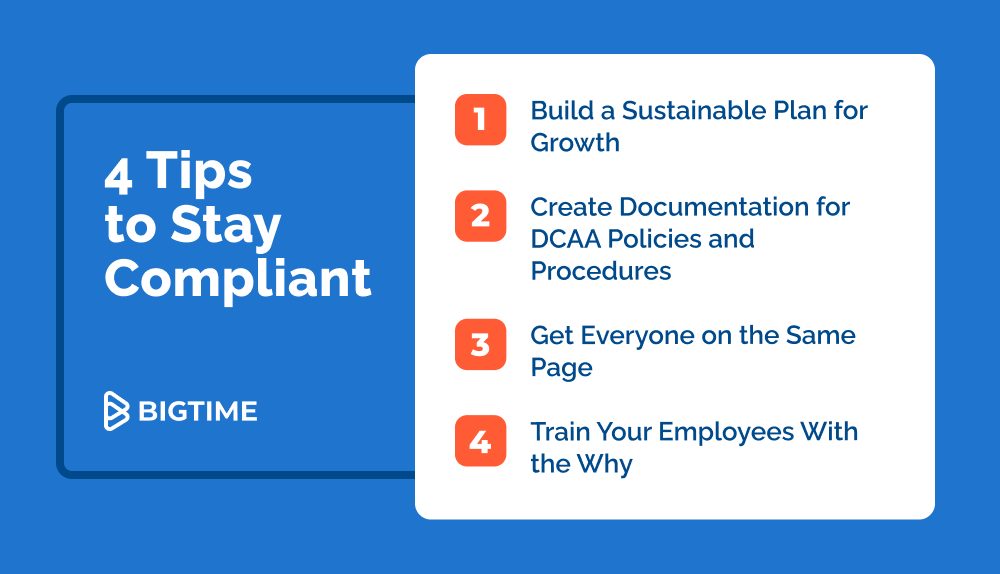

4 Tips for Staying DCAA Compliant

When it comes to DCAA compliance, the answer to the little voice in your head is yes. Yes, you should make sure you’ve built a strong foundation, even if it means more leg work up front, it’ll save you from a scramble at the end when being organized really matters.

If you’ve already forged ahead, it’s not too late to go back and reassess the process in place to make sure you’re on the right path for growth.

So, let’s make a plan. Follow these four steps to invest in the success of your DCAA compliance and it’ll be smooth sailing ahead.

Tip 1: Build a Sustainable Plan for Growth

Even small firms need to think big when it comes to government contracting. Growing a business on a manual process, that may work for the initial project, will keep creating more work down the road.

Remember to think long-term when you’re planning out your process for compliance. Finding a PSA software that is flexible enough to grow with your firm allows you to adapt to the process, rather than having to reinvent the wheel in each new phase of business.

Tip 2: Create Documentation for DCAA Policies and Procedures

Having a formal policy for DCAA time tracking and building your audit trail is required by the DCAA, along with an accompanying procedure document detailing the process. Resist thinking of this as just another compliance step to cross off the list, and use the opportunity to get your whole firm organized.

Although some of the compliance rules seem tedious, there are a lot of good ideas built-in for aligning your time tracking, budgeting, capturing costs, and invoicing. Keep notes as you plan, or enlist the help of a consultant from the beginning to help you build out your own custom “formula” for success. This will save you money down the line of having to hire a last-minute consultant when an audit strikes.

Tip 3: Get Everyone on the Same Page

Standardizing your firm’s internal management and time tracking system for all employees is the safest route. Even if government contracting is only a branch of your business, you never know when you’ll need to pull in an additional resource, and ultimately one process keeps things less complicated and organized.

Communication is key to making the adoption seamless for everyone in your organization. Aim to make the transition swiftly to avoid messy records and overlaps. Change is hard in the beginning, but everyone will adapt to the new norm with time. Check out this blog on tackling change management to learn best practices for implementing a new system at your organization.

Tip 4: Train Your Employees With the Why

Often the biggest pain point in service firms, and even more crucial in those who need to be DCAA compliant, is operations doesn’t give accounting the information they need. Many businesses make the mistake of training their employees on their processes, but leave out the essential “why”. Why am I doing this? Why is it important? Why were these steps put in place? It’s human nature to give more care and thought to our actions if we know the purpose behind them.

When training operations on the needs of DCAA compliance, and staffers on their time tracking, make sure to communicate the importance of the audit trail. Explain how the regulations impact the way accounting is able to build your documentation and the possible consequences that come from failing an audit.

Frequently Asked Questions About DCAA Compliance

What is DCAA?

DCAA stands for the Defense Contract Audit Agency. This agency is responsible for ensuring the government’s financial resources are used efficiently and effectively. They do this by performing audits to identify any potential risks, errors, or fraud in the contracting process.

What is DCAA compliance?

DCAA compliance means meeting the regulations and standards set by the Defense Contract Audit Agency for government contractors. It includes specific requirements for timekeeping, accounting, internal controls, cost accounting, and financial reporting to manage resources effectively and use accurate financial data

What are DCAA timekeeping requirements?

DCAA timekeeping requirements involve daily timesheet completion, clear project descriptions, accurate overtime and time off recording, and separate approvals for timesheets and payroll. Integrating time tracking and accounting systems can save time and costs.