Last updated November 20, 2023

If this year has taught us anything, it’s that a tighter and more streamlined payments process is the easiest way to retain and grow cash flow. The more automated the invoicing and payments process is for your clients, the faster you get paid – on time, every time. But what can we expect going into 2024?

I recently hosted a webinar with 2 other payments pros (watch the recording here) where we shared our expertise in the payments space, key insight into industry trends, how professional services firms can adapt to those changes, and what we can expect going into 2024.

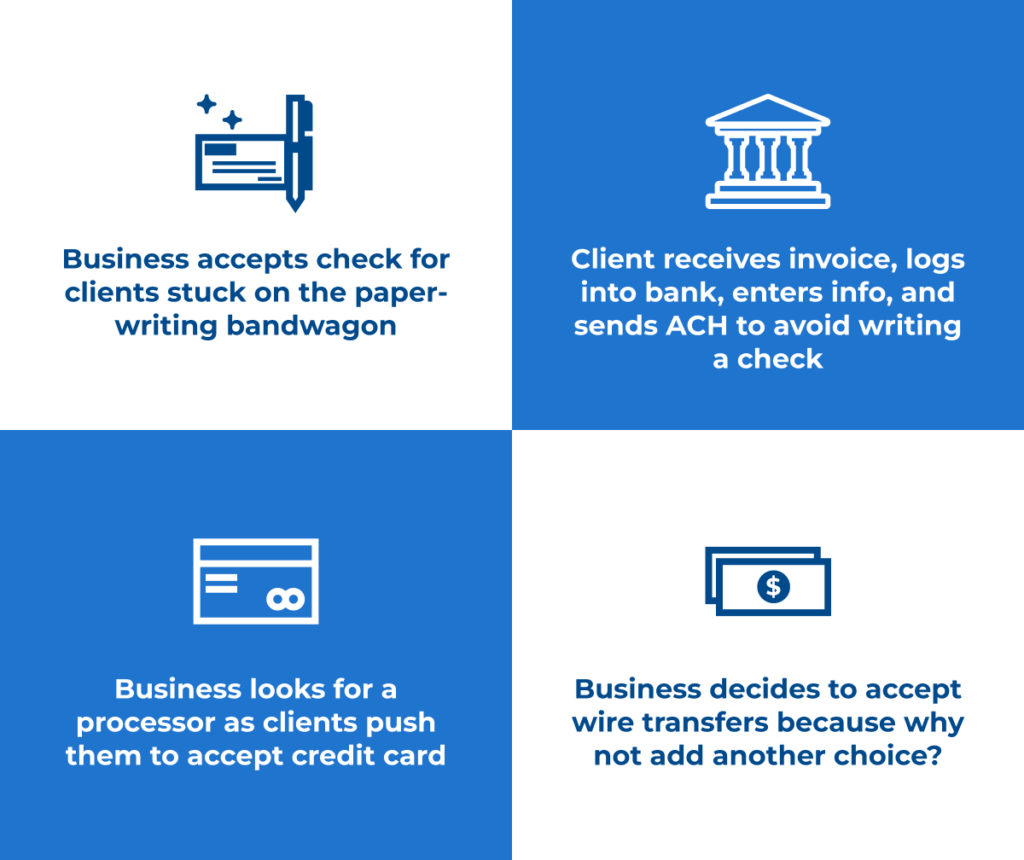

4 Traditional Payment Options

1. Paper Checks

Accounting for nearly 50% of business-to-business payments, paper checks are still the most common way of getting paid — and the most inefficient. Clients are used to the status quo of checks but this exposes all parties to security risks and added costs when it comes to reconciling the payment. In fact, it is “estimated that check fraud will reach at least $24 billion or more this year, up 50% from 2018’s levels.”

2. ACH Payment

The next most common way for a business to get paid is through a bank transfer or ACH payment. The money movement occurs digitally but at the cost of a time-consuming effort by your client and still requires manual reconciliation by your firm. You also disclose sensitive information (bank account number and routing number) to get paid. The majority of ACH payments take between 5-7 business days to fully process, however, a lot of work is being done to expedite this flow.

3. Credit/Debit Card

The third payment option is the fastest-growing method of getting paid and that is a credit or debit card. Traditionally, a business would have to work with a bank, credit card processor, or independent sales organization to go through a 2-4 week process of mailing, faxing, and uploading a large set of documents to simply get approved for a merchant account. The problem is there’s no pricing transparency and a continued lack of automated reconciliation.

4. Wire Transfers

The last of the different payment methods is wire transfers. Wire transfers can serve a good purpose, which is a one-time payment or to complete an infrequent cross-border payment. Outside of those two use cases, the limited ability to track and trace the payment is not worth the time if you have a handful or more of invoices being sent per month. It’s also the second most targeted payment method for fraud behind paper checks.

The New Way Forward for Payments and Invoicing

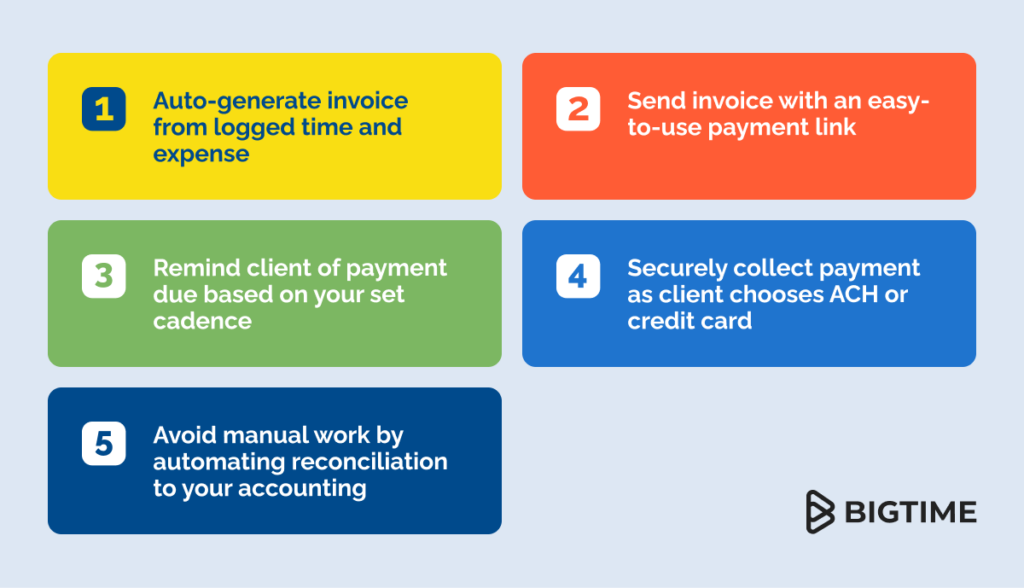

An ongoing trend we continue to see rise is the expanded role of an operating platform to deliver online payments. Beyond adding a project, assigning staff, managing budgets, and logging expenses and time, now firms look to round out the project lifecycle with invoicing and payments. Instead of going to one of many parties and processes to handle payments offline, firms can now look for Professional Services Automation (PSA) software that has an integrated payments solution online.

No more collecting payments outside of your central operating platform and having to manually match to the right customer invoice to then mark it as paid in your accounting software. Now you can use PSA software to auto-generate the invoice and enable the easy-to-use payment link for your clients to get you paid in minutes.

The client has the convenience to pay with a credit card, debit card, or ACH and you can receive your funds as soon as the next day. And even better, the invoice will be automatically matched to the payment and your QuickBooks accounting software will be automatically synced. There is a tremendous amount of time saved by keeping the full invoicing and payments flow self-contained within your operating platform.

To make payments even faster, BigTime offers next-day funding for ACH. This represents a huge opportunity to improve cash flow for firms by freeing up valuable funds that would have previously taken 5 days to use, and now can be used in 1 business day.

Invoicing + Payments = Better Together

Continuing with the value of payments and invoicing, we want to share some of the results our customers are seeing by having invoicing and payments together on the same platform. Numbers tell a story, which is why we’ve been mining our data to uncover facts and figures based on BigTime users, who have their invoicing and payments together on the same platform.

How long does it take a business to get paid from invoice sent to payment received?

BigTime customers who use BigTime Invoicing and BigTime Wallet, with set payment terms, get paid in 9.6 days vs. an industry average of 29 days. To put things in perspective, other studies show 30-45 days as the average time for a business to get paid. This means BigTime customers are seeing an improvement of 3x and getting paid at least 19 days faster.

BigTime customers are also seeing nearly 87% of their invoices paid on time vs. an industry average of 61% of invoices paid on time. A common challenge we hear from our customers is “How do I reduce the unpaid invoices I have?” Moving to a combined invoicing and online payments solution gives you a big jump and revisiting your collections processes can help as well.

The Do’s and Don’ts of Invoicing & Payments

As a part of our research, we’ve also uncovered invoicing practices that drive better outcomes for your firm. We analyzed over 600,000 invoices from the first part of 2022 and uncovered a couple of interesting findings.

Don’t make your customers guess when they should pay your invoice. It’s important to make it clear to clients when the invoice is due. Keeping your invoice terms concise will ensure there is no misunderstanding. Simply write the invoice term as Net 30 if you expect a client to pay the invoice in 30 days.

Don’t rely on your clients to decipher when they should make the payment. If you’re adding anything additional like an early payment discount, make sure you are following a standard invoice format.

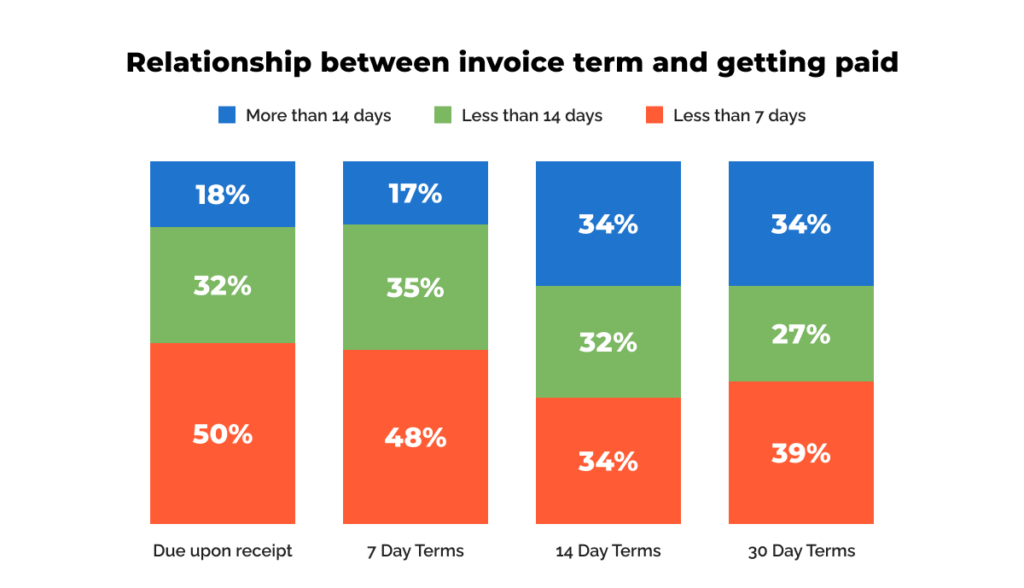

Do strike a balance when setting invoice terms. The first research we did was reviewing the relationship between a firm’s invoice terms and how quickly they were paid. We looked at some of the more common invoice terms ranging from due upon receipt to 7-day, 14-day, and 30-day terms. Not too surprisingly, the shortest invoice terms result in the shortest amount of days to get paid.

If you request an invoice to be paid upon receipt, on average you will see 50% of invoices sent out of BigTime paid in less than 7 days. However, if you request an invoice to be paid in 30 days, you will only see 39% of invoices paid in less than 7 days.

If you give clients more time to pay then generally speaking, they’ll take advantage of that additional time. Ideally, your invoice terms should strike a balance between helping you get paid quickly and keeping a healthy relationship with your clients.

Do be polite! Don’t be shy in mentioning please and thank you somewhere in your invoice notes. This has proven to speed up payment by 2 days.

Do discuss your invoice terms early in the process. Have this conversation at the time of the contract but make sure you continue including your invoice terms on the invoice itself. We saw quite a few invoices that direct the customer to reference the contract for invoice terms. Go ahead and restate your invoice terms so you can protect yourself from your client forgetting what may have been discussed months ago.

Do have more payment choices. More options equal happier clients who are more likely to pay you quicker. Including multiple payment methods like credit card, debit card, and ACH will cover the majority of situations.

Payment Trends Heading Into 2024

One big trend from last year that we’ll definitely see more of in 2024 is payment flexibility. When it comes to receiving payments, we’re seeing firms get more creative in how they use invoice reminders based on client or invoice size.

BigTime released expanded invoice reminder functionality this year that now allows you to configure up to 6 email reminders. You can set 3 reminders pre-due date and 3 reminders if the invoice becomes overdue. This can be done at the client level, as you probably know which clients need the reminders vs. which are already paying on time.

There’s also been an increase in firms considering recurring services and exploring auto payment use cases, which we just released a few months ago. Who wouldn’t want to put more of their accounts receivable process(es) on autopilot?As for flexibility with making a payment, clients are advancing their AP practices to online and looking for easy ways to route payments. A recent study showed that 73% of businesses are moving from paper-based payment practices to online. Another example of flexibility is more control for the payer on when they want to make the payment. This is why our scheduled payments feature is so important to us.

Control Cost of Payment Processing

Why do payment processing fees exist? When a client pays an invoice with a credit card, you typically get that payment in your account in 2 days even though the client (business or consumer) hasn’t paid for that transaction and may not pay for 30 days. The client may also be paying in monthly installments so you are paying to receive that money right away.

Most of the money that comes out of the transaction fee is not from your software partner and not from the payment processor. It’s the bank that issued that card to the business or client. The bank is the one that bears the brunt of the liability as the client could default on the payment and the bank is then responsible for the write-off, so they take home the biggest cut. The next party who takes a cut of the transaction is the card brand like Visa, Discover, American Express, or Mastercard.

The last group with the smallest cut is the payment processor and software platform which set up the merchant to receive payments and manage the operational flows when the payment is successful or unsuccessful. The most controllable way to lower costs is to offer multiple ways to pay. Leverage ACH as a payment option that has either a lower percentage of the transaction fee or a maximum dollar amount per transaction.

At BigTime, we offer next-day ACH processing so you are receiving payment off a credit card, debit card, or ACH within 2 days of transacting. We know how important steady cash flow management is to your firm, and receiving funds at least 3x quicker can be material to running your business operations.

Ready to explore how BigTime Wallet can help your firm get paid faster? Schedule a time to chat with Collin, our BigTime Wallet expert.