Last updated February 15th, 2023

It’s no secret every aspect of your business benefits from aligning to others. Silos help no one in achieving more productive project management. What’s challenging for many businesses is finding the proper way to execute two-way communication. Most often it’s because either the right channels aren’t in place, or expectations are not clear.

Accountants are beneficial allies for many departments, and when paired with project managers your decision making and internal operations will become more proactive. As combined forces, the two teams can become important advocates for strong financial reporting and better management processes.

As a result, a key strategy to increasing project management productivity is by project teams and finance teams working together. Follow our 5 steps to make sure you’re getting all the value you can out of the two teams working in sync.

How to Increase Productivity in Project Management Through Joint Team Efforts

Step 1 – Align the teams

It’s essential that both finance and project teams are all on the same page have a clear understanding of project objectives. Take the time to make sure everyone knows the project goals, how they will be measured, what success looks like, and any obstacles there may be. When everyone is united under one objective, it creates an environment of cooperation and collaboration that helps ensure a successful outcome and more productive project management.

Step 2 – Keep communication open throughout the project

To have a successful project, you must establish open communication channels between the finance and project teams. This includes regularly scheduled meetings, check-ins, and updates on how the project is going – not just at the beginning and end points.

How involved the accounting team is will depend on the level of risk, the higher the stakes the more involved – but in most cases, the goal is to stay accessible. The accounting team should act as a supporter of the project, not controlling. Additionally, quick interaction or conflict resolution strategies should be addressed early in order to move everything forward effectively and improve productive project management.

Step 3 – Streamline reporting

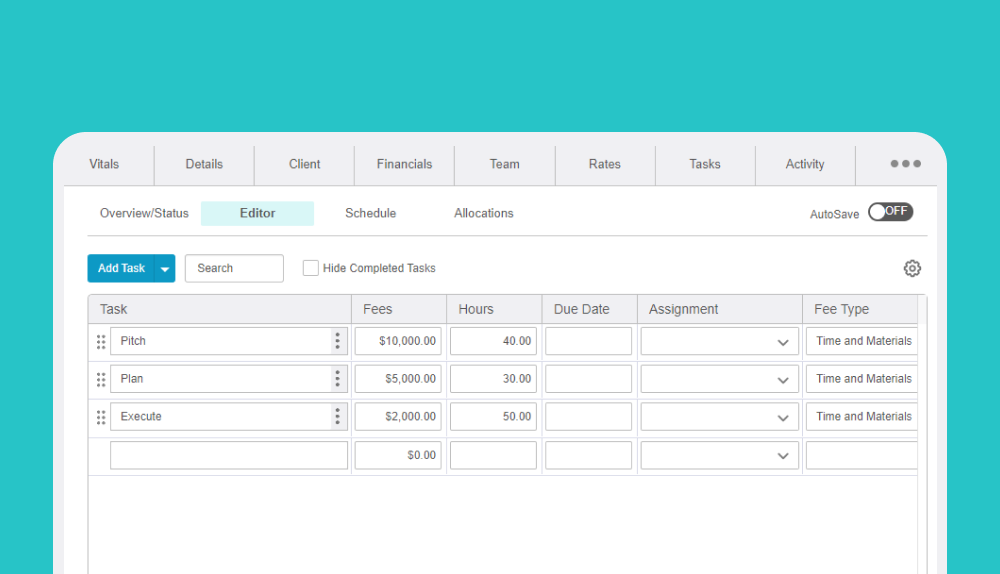

Streamlining the reporting processes will help eliminate miscommunications and misunderstandings which could result in costly delays to the project. Open communication becomes much easier when it’s less dependent on manual work, and more is automated. An automated solution such as time and billing software can fluidly send reports on WIP and budget statuses to project managers, without having to wait for accounting to send. Receiving this critical information in real-time is what makes it easier to say on top of project planning rather than reactive.

Ensure that reports are detailed and organized, giving both team members a clear view of project analytics and the progress being made. Build a timeline for completion and hold everyone accountable for each individual step, helping reduce time spent debating about discrepancies or confusion. This is also an ideal time to create a transparent system around decision making so that finance and project teams have an understanding of who is responsible for certain decisions within the life of the project.

Step 4 – Manage risks in sync

Risk management is the process of analyzing and mitigating risks associated with a project. Managing risk is impossible to do all at the start of the project, and becomes much more real after the project has begun. When project and finance teams are working together, the risk management process is managed in close sync with the financial considerations involved.

The accounting team can help by thinking like an auditor throughout the process. By presenting relevant business rules and “auditing” phases of the project as they’re completed can help keep the project better on track with client and internal goals. Continual involvement from accounting always plays into preventing any bottlenecks that can happen when a challenge arises. Instead of having to be caught up to speed, they can weigh in immediately.

Step 5 – Learn from mistakes

Mistakes made in the past can provide great insight into how to prevent similar issues from arising during a project. Both project accounting and project managers should analyze what went wrong, where and why things went wrong, and what could have been done differently can help teams create a better risk management plan for future projects.

Project managers should focus on where they can correct problems in the project process, and accountants should asses if their involvement helped move the project forward or if they held things up, and how to reduce risk. Doing so will not only help reduce costs associated with these mistakes but it will also give managers peace of mind that their teams are working diligently on preventing recurring risks.

Summary: Productive Project Management

Managing projects effectively and efficiently is essential for success. It’s even more important when teams have to work together, in this case project teams and finance teams. Here are 5 strategies you can use to increase levels of productive project management and ensure a more successful outcome for all involved:

- Align the project teams and the finance teams

- Keep communication open throughout the project

- Streamline reporting

- Manage risks in sync

- Learn from mistakes

These steps are essential to project delivery success and scaling a consulting business. If your processes never evolve and teams don’t get on the same page, you can’t expect anything to scale. To learn how BigTime can help your firm with this process and discover additional resources related to improving project profitability, visit our resource library here.

Frequently Asked Questions About Productive Project Management

How can project productivity be improved?

One strategy for improving project productivity is to have project teams and finance teams working together. Five tips for increasing levels of productive project management this way include:

- Aligning the teams – Everyone should have a clear understanding of project objectives.

- Keeping communication open – Establish open communication channels.

- Streamlining reporting – Automated solutions can send reports on project and budget statuses.

- Managing risks in sync – Analyze and mitigate risks together to keep financial considerations involved and projects on track.

- Learning from mistakes – Analyze what went wrong, where and why to prevent similar issues from reoccurring.

How can project managers improve productivity?

Project managers can improve project management productivity by focusing on clear communication, effective planning, optimized resource scheduling, defined risk management, and a continuous improvement mindset.

What is productive project management?

Productive project management is an approach that focuses on streamlining processes and making the best use of available resources to optimize efficient and successful project delivery.

How can a project manager be more productive?

Project managers can be more productive by focusing on:

- Task prioritization

- Cross-department collaboration

- Planning and organizing

- Effective communication

- Automation and technology

- Continuous improvement

- Delegation

- Time management

- Resource optimization