What is ASC 606?

ASC 606 provides a single comprehensive model for entities to use in accounting for revenue arising from contracts from customers and is the current standard. Compliance with ASC606 regulations regarding revenue from contracts with customers can be challenging. ASC 606 outlines a five-step model that requires companies to exercise more judgement and make more estimates when considering the terms of a customer arrangement or contract.

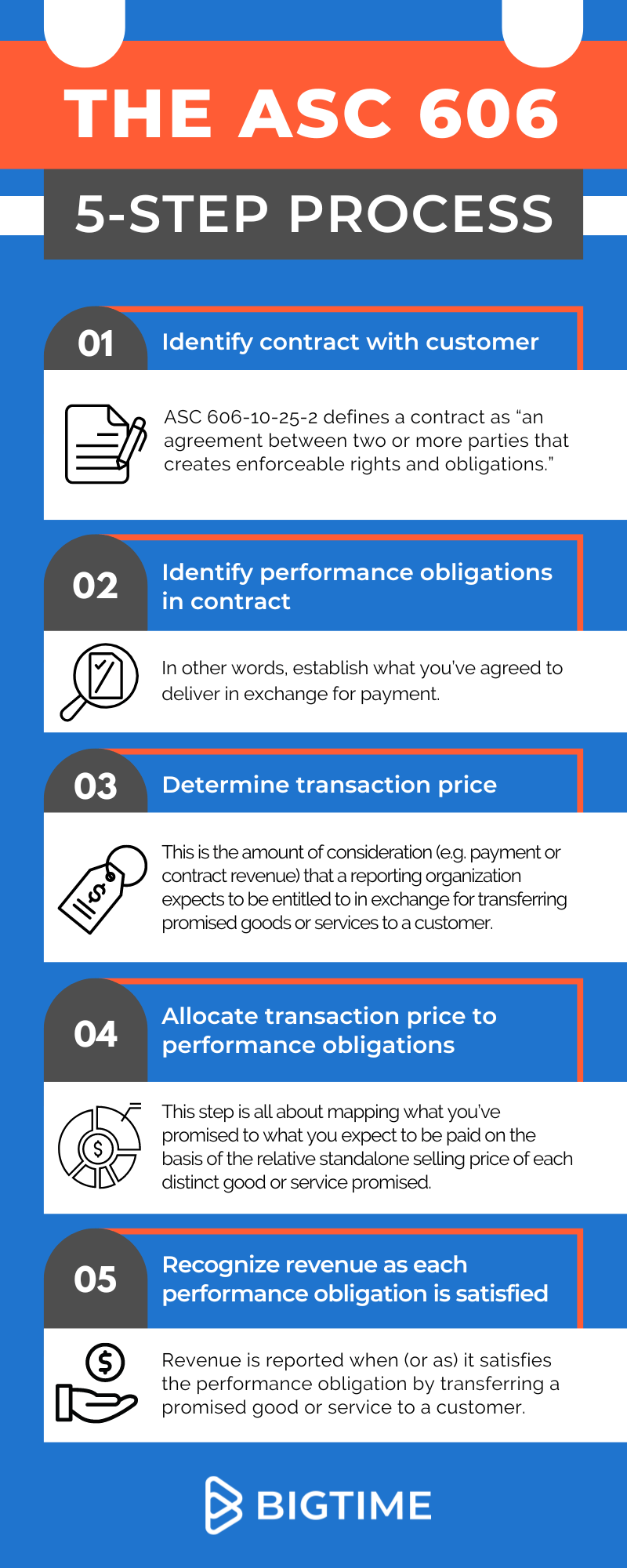

The ASC 606 5-Step Process

This executive overview is a high-level, simplified understanding of ASC 606, the five steps involved, and the revenue recognition tools needed for consulting companies to get it right.

These are the 5 steps that comprise the revenue recognition standard.

Step 1 – Identify the contract with a customer

ASC 606-10-25-2 defines a contract as “an agreement between two or more parties that creates enforceable rights and obligations.” This means a contract needs to show:

- Commercial substance exists

- Approvals have been obtained and a commitment to perform exists on the part of both parties

- Rights of both parties are identifiable

- Payment terms are identifiable

- Collection of substantially all of the amount to which the entity will be entitled in exchange for the good or services that will be transferred to the customer is probable (likely to occur)

Guidance on contract modifications is provided in the ruling to help model contracts that may change over time, including pricing and scope changes. These and other changes might result in a separate contract to the current one, or possibly an entirely new contract for the engagement.

BigTime Tip: Establish consistent language with your sales, executive and project teams for determination of contract type; identify ahead of time which exceptions may occur (as much as you can) and decide on appropriate action to take when changes arise.

Step 2 – Identify the performance obligations in the contract

In other words, establish what you’ve agreed to deliver in exchange for payment. Many times, services related to a given contract will need to be accounted for separately. It is the responsibility of the service provider (agency, consultant, etc.) to determine whether all services it provides for a given customer should be accounted for as one unit or as separate items. There are generally two steps:

- First, understand and identify all deliverables (promises to provide services)

- Second, determine whether the promises/goods or services that will be delivered should be accounted for separately

Some service contract types referred to as “stand ready obligations” have very specific rules. An example of this type of professional services contract might be a maintenance agreement where an agency contract agrees to provide services when needed or desired. If the type or quantity of services planned to be provided is unknown or unspecified, it is likely a stand-ready obligation.

BigTime Tip: Different contract structures have different requirements for revenue recognition. Projector by BigTime, for instance, has seven default types as well as the ability to add other contract types as needed. You can read more about professional services contract structures, and you can always refer to this Financial Accounting Standards Board (FASB) resource on ASC 606 and revenue recognition for more on the topic.

Step 3 – Determine the transaction price

The transaction price is the amount of consideration (e.g. payment or contract revenue) to which a reporting organization expects to be entitled to in exchange for transferring promised goods or services to a customer. This amount excludes third party obligations like sales tax. It should take into consideration discounts, incentives, rebates and other price concessions.

For considerations promised in a contract that are of variable amounts, you must make a good faith estimate of the amount, only to the extent that it is probable that a significant reversal in the amount of the revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved.

BigTime Tip: Integration of project accounting with your professional services automation (PSA) software and CRM is key to ensuring contract details are seamlessly collected, associated and tracked at a project level. Manual revenue reconciliation using Excel spreadsheets simply will not scale.

Step 4 – Allocate the transaction price to the performance obligations

This step is all about mapping what you’ve promised to what you expect to be paid on the basis of the relative standalone selling price of each distinct good or service promised. Once again, if you’re using a PSA, this is simply breaking down the contract into the logical parts based on what and when obligations will be delivered.

Variable considerations require additional scrutiny to properly apply ASC 606 revenue recognition rules, specifically as it relates to distinct goods or services that make up a series but are treated as a single performance obligation.

BigTime Tip: Organization-wide visibility of timelines and deliverables is easily achieved with even a basic PSA tool. The best PSA software will allow the organization to customize their accounting structures based on their needs, acting as revenue forecasting software to include everything from modeling managed services contracts to accounting for business development work.

Step 5 – Recognize revenue when (or as) each performance obligation is satisfied

Revenue is reported when (or as) it satisfies the performance obligation by transferring a promised good or service to a customer. This differs from when cash is received (more on the revenue recognition concept here). The amount recognized is the amount allocated to the satisfied performance obligation established in Step 4.

Obligations can be satisfied at a point in time (typically when promised goods are transferred to a customer) or over time (typically used for services delivered to a customer across a duration of time). Revenue recognition for consulting companies, agencies and IT services teams typically work with an “over time” model and it is essential that an appropriate method for measuring and reporting progress is in place.

BigTime Tip: Project reporting and financial reporting must work together. Ideally, the system for revenue recognition that you put in place will include integration with project planning and time tracking. This allows forward-looking projections that enable proper accounting when the time comes, but also insight into issues like missing time or projects going off track.

A Note About Disclosures:

Part of the burden of reporting revenue is also the need to provide disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from an organization’s contracts with customers. This information is both quantitative and qualitative in nature and serves to help financial statement users understand the nature, amount, timing and uncertainty of revenue and related cash flows. It is important to note that while publicly traded entities have the largest burden for disclosures, non-public entities must also provide context for their financials.

You can find out more about FASB accounting, ASC 606 rules and the latest questions on ASC 606 in the FASB’s revenue implementation FAQ.

ASC 606 Revenue Recognition Summary

The ASC 606 5-Step process for revenue recognition includes the following:

- Identify the contract with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognize revenue when (or as ) each performance obligation is satisfied

As ASC 606 clearly outlines, contracts are the basis for how organizations must recognize revenue, but this doesn’t need to be a burden on your accounting staff or on anyone else in the organization. With a bit of forethought and planning, and the right tools (e.g. a PSA system) for ASC 606 revenue recognition and reporting, you can easily:

- Establish the processes and automate the data necessary to conform with ASC606

- Manage allocation methods based on the type of performance obligation specified in the contract

- Configure and add new types of contracts or allocation methods as your business evolves

Talk to us any time about how revenue recognition software like BigTime helps services organizations and consulting companies follow GAAP accounting rules, better manage their operations and drive higher profits.

Frequently Asked Questions About ASC 606 Revenue Recognition

What is ASC 606?

ASC 606 outlines a 5 step model for entities to use in accounting for revenue arising from contracts from customers. It requires companies to exercise more judgement and make more estimates when considering the terms of a customer arrangement or contract.

What is ASC 606 revenue recognition?

ASC 606 is a revenue recognition standard for entities to use in accounting for revenue arising from contracts from customers.

What are the 5 steps for revenue recognition with ASC 606?

The 5 steps that comprise the revenue recognition standard are:

1. Identify the contract with a customer

2. Identify the performance obligations in the contract

3. Determine the transaction price

4. Allocate the transaction price to the performance obligations

5. Recognize revenue when (or as) each performance obligation is satisfied

What does ASC 606 stand for?

ASC 606 means Accounting Standards Codification and is an accounting standard defined by the Financial Accounting Standards Board (FASB) that outlines how to recognize revenue arising from contracts from customers.

Does ASC 606 replace ASC 605?

Yes, ASC 606 is a revenue recognition accounting standard that replaces the former ASC 605 and requires more comprehensive disclosures.